Employers failing to come clean over pension proposals to cut defined benefits

28 May 2021

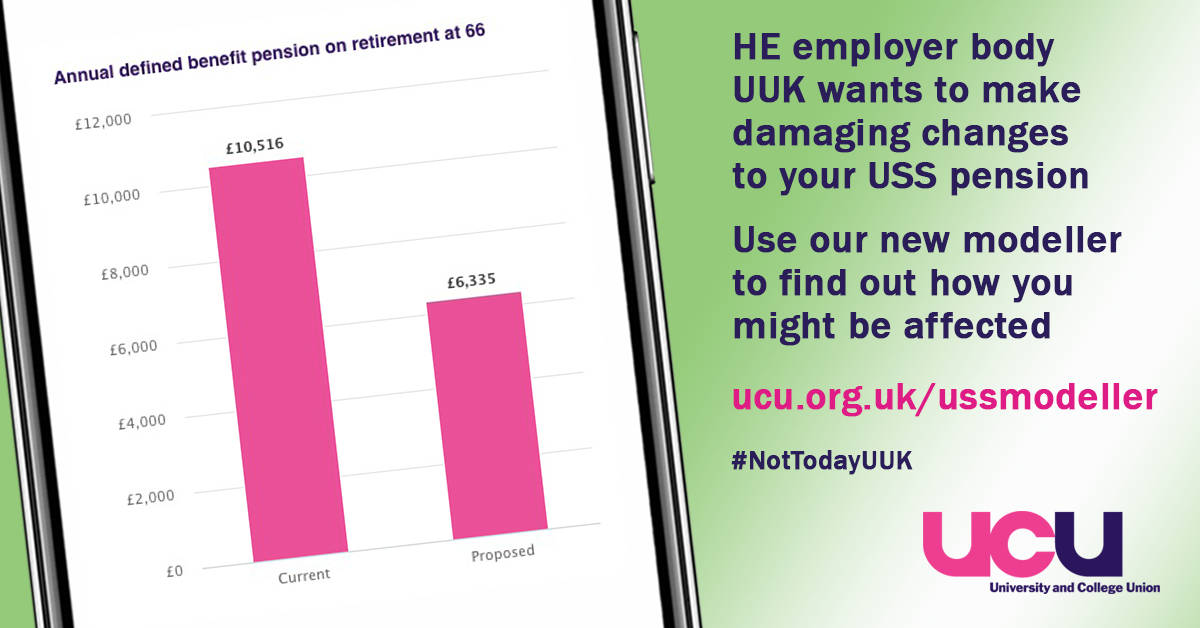

- A typical member of staff could suffer a 35% cut to their guaranteed retirement benefits for future service

- Proposals would create two-tier workforce

UCU has accused employers' representative Universities UK (UUK) of failing to come clean over the true impact of its Universities Superannuation Scheme (USS) pension proposals. The union says they would devastate the finances of university staff, especially workers at the start of their career, and risk collapsing the scheme entirely.

The warning from UCU comes on the day it unveils a new USS pension modelling tool, developed by First Actuarial. It allows members and potential members of USS to see the impact UUK's proposals would have on their defined benefits - for a typical USS member, it shows a cut of over two-thirds (35%) to defined benefits that will be accrued in the future.

The USS pension scheme, home to the retirement funds of 460,000 people, is conducting a 2020 valuation and claiming that contribution rates - currently at 9.6% for members and 21.1% for employers - need to increase.

USS's valuation methodology and governance have come under heavy criticism in recent years from a range of experts and institutions, including the universities of Oxford and Cambridge, the former Governor of the Bank of England, and a Joint Expert Panel of pensions specialists created in the wake of industrial action in 2018. UCU and their advisers, First Actuarial, along with UUK's advisers, Aon, have all argued that increases relating to the 2020 valuation are not justified. However, UUK has capitulated to USS's demands and proposed major changes and cuts to the guaranteed, defined benefit element of the scheme to keep contributions at their current rate.

UUK's proposals to downgrade USS pension benefits include:

- lowering the salary threshold where defined benefit accrual stops from £59,883.65 to £40,000

- reducing accrual (and therefore the size of payments in retirement) from 1/75 to 1/85

- imposing a consumer price indexation cap of 2.5% (removing the protection of benefits against any inflation above that level).

UCU says this would drastically reduce the guaranteed retirement income of members of USS, hitting those at the beginning of their careers hardest, who are more likely to be on casualised contracts, on lower pay, have substantial student debt, and have fewer assets. The union says this would create a two-tier work force and is particularly 'galling' when UUK is proposing not to increase employers' contributions to the scheme.

Using the tool, staff can enter their age, current salary, and potential future changes to their salary, and see how much they would lose under UUK's proposals.

The UUK proposals would only affect benefits relating to future service, not for past service as a USS member. While the cuts would be partially mitigated for those staff who have already accrued significant benefits under the current arrangements, staff nearer the beginning of their careers would not be protected in the same way.

This new threat to degrade pensions comes after two waves of industrial action in 2018 and 2019-20 when UCU members rejected similar proposals from employers. It also comes after a series of changes between 2011 and 2019 that have already been shown to leave a typical member around £240,000 worse off.

UCU said further industrial action could not be ruled out if USS and UUK fail to heed the advice of the Joint Expert Panel, which twice confirmed the scheme was sustainable and that defined benefits could be made more affordable.

UCU general secretary Jo Grady said 'Universities UK is trying to hoodwink staff into signing up to pension proposals which fall apart at the first sign of scrutiny. Reducing the level and the security of benefits will pull the rug from under people's retirement and threaten the viability of the entire scheme as people question why they should remain a part of it.

'Our modeller shows the impact of UUK's proposals falls particularly hard on those at the start of their careers, who are more likely to be on low pay, and on casualised contracts - it is incredible that USS and UUK are trumpeting these proposals without providing any meaningful information about the impact on staff. The plans would further cement a two-tier workforce.

'The answer to concerns about the scheme's affordability is for vice-chancellors to show the same faith in higher education that their staff do - and to listen to the experts who say the scheme is sustainable. Increased guarantees from employers on staying within the scheme must be matched with a concerted effort to push back on bogus claims that defined benefits are unaffordable.

'University staff have had their pay held down by employers for years, they will not stand for USS and UUK colluding to slash their pensions. In the coming days members will formally decide the next steps in the union's campaign to defend USS pensions. Should USS and UUK continue down their current path, we cannot rule out industrial action.'

Use the tool to see how your pension would be affected here.

- PrintPrint this page

- Share